Ghana PAYE / SSNIT Calculator app for iPhone and iPad

Developer: LeafeCodes Inc

First release : 07 Feb 2020

App size: 7.14 Mb

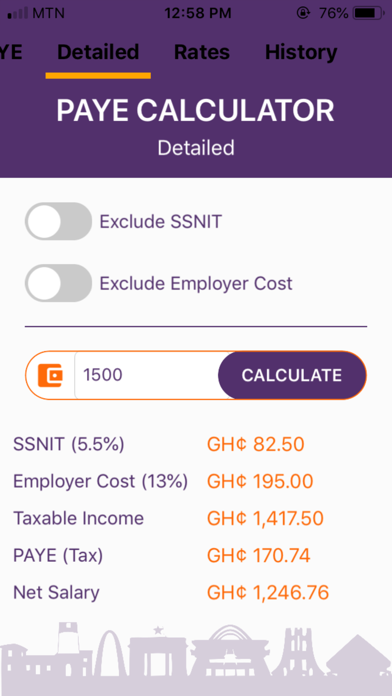

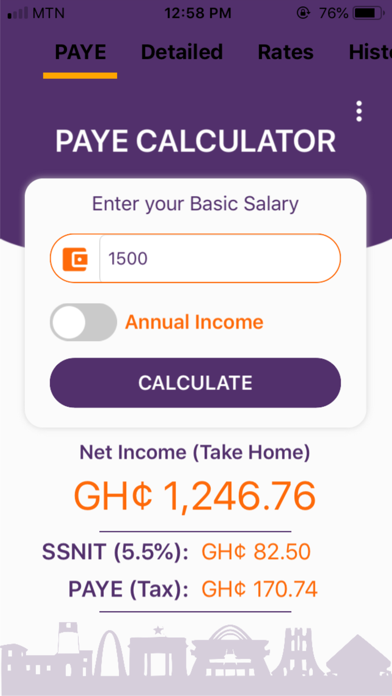

Ghana PAYE Calculator calculates your Income Tax based on your Salary and SSNIT Contribution (5.5%) and gives you an accurate representation of what you are to pay. This part is useful for everybody. The User Interface is neatly designed and easy to use.

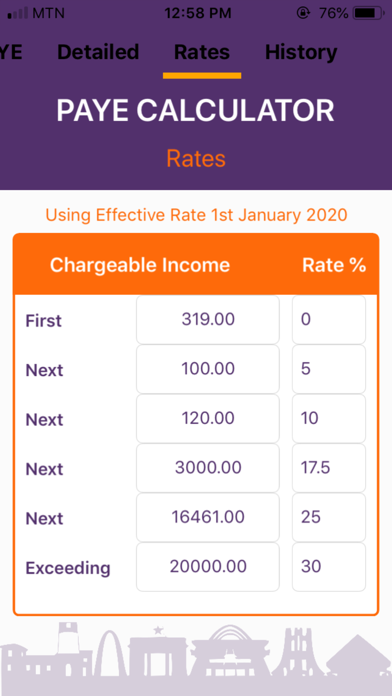

It is built using the latest Tax Rates from Ghana Revenue Authority ( GRA ).

If you are a student or a lecturer, employer or employee or just an ordinary citizen interested in knowing how much your SSNIT Contribution or Income Tax Deduction (PAYE) is calculated and how much you ought to pay, this application will put you in the right direction.

Features:

1. Quick Calculations

2. Detailed Calculations

3. Calculates VAT on goods and services (VAT, VAT Reversal, and VAT Flat Rate)

4. Custom Tax schedule (Includes previous tax schedules)

5. Easy to use interface

6. Calculates Net to Gross Salary and Gross to Net

7. Overtime tax, Bonus Tax, Tier 1, Tier2 and Tier 3 (Provident Fund) Calculations

8. Net to Gross Salary Calculation

9. Tourism Levy Calculation